❄️ Introduction: Niseko’s Meteoric Rise

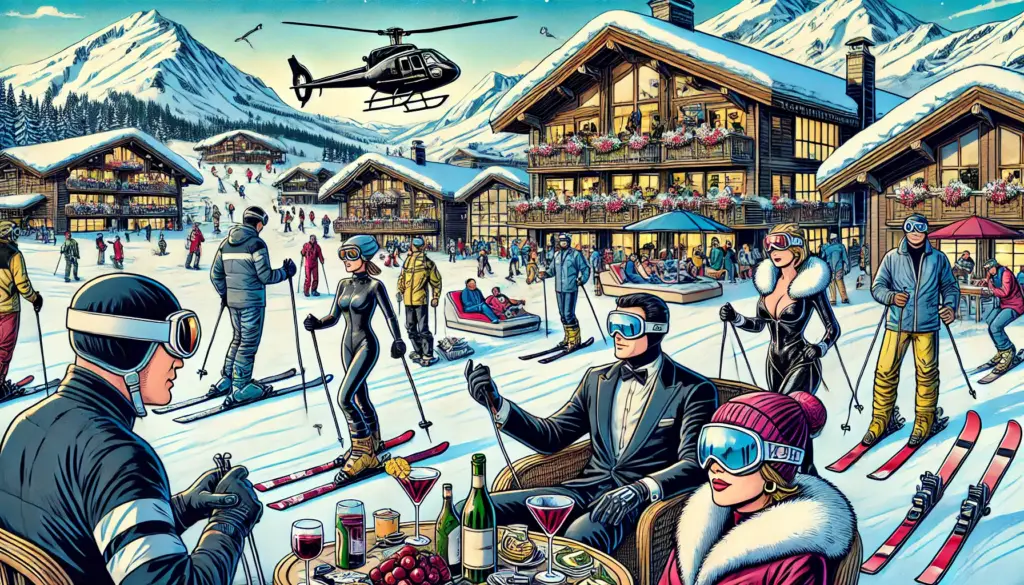

Over the last two decades, Niseko has undergone a dramatic transformation. What was once a sleepy ski town in Hokkaido known mainly to domestic tourists has become one of the world’s most luxurious winter destinations. Today, Niseko is a hub for billionaires, celebrities, crypto millionaires, and tech entrepreneurs from across Asia-Pacific.

The result? A “Niseko Bubble” fueled by international real estate speculation, luxury tourism, and growing infrastructure. But is this a blessing or a burden for Hokkaido and Japan at large?

Let’s explore whether Niseko’s success could reshape Hokkaido into a high-end enclave — and what it means for local communities, culture, and economics.

🏔️ Chapter 1: The Origins of the Bubble

Niseko’s transformation began around 2004 when Australian investors, attracted by the quality of Japan’s “Japow” (Japan powder snow), began buying up old lodges and ski chalets at bargain prices. They saw what few others did at the time — potential for a high-end winter resort with international appeal.

By the 2010s, investment surged. Hong Kong developers, Singaporean family offices, and Chinese tech billionaires followed. In the post-COVID era, new buyers from the UAE and North America joined the party, looking for real estate diversification and lifestyle assets.

Niseko evolved rapidly:

- Ski resorts became privatized and branded.

- English became the dominant language in signage and services.

- International schools and childcare centers opened to support expat families.

- Restaurants adapted to global palates, offering wagyu truffle pizza and caviar soba.

Niseko was no longer just a ski destination — it became a lifestyle brand.

💰 Chapter 2: Real Estate Boom or Bubble?

Land prices in the Niseko area, particularly in Kutchan and Hirafu, have increased by more than 600% since 2010. Luxury chalets sell for over ¥1 billion JPY (approx. $7M USD), often purchased as vacation homes or investment properties by foreigners.

A quick look at the numbers:

- 2023: Average condo price per square meter in Hirafu exceeded Tokyo’s upscale Minato ward.

- 2025: Over 40% of central Niseko land ownership is foreign-held.

- Construction permits have doubled since 2022 in the area, as developers race to meet demand.

However, these skyrocketing prices have excluded local residents from ownership. Families that have lived in Kutchan for generations are finding themselves unable to afford property taxes or rent. Some have sold and left; others now work in the tourism industry catering to those who replaced them.

It’s a textbook case of gentrification, set in the snowy hills of rural Japan.

🧑🌾 Chapter 3: Economic Opportunities and Local Displacement

There is no denying the economic boost Niseko’s boom has brought:

- Local employment has risen in construction, transportation, food service, and cleaning.

- Town budgets have improved thanks to tourism-related taxes.

- Global exposure has encouraged younger Japanese to return to Hokkaido for jobs.

But the downside is more complicated:

- Most managerial and ownership-level roles are foreign-held.

- Profits are often sent abroad rather than reinvested locally.

- Infrastructure is overstretched during the peak season but underutilized in summer.

Additionally, rural villages surrounding Niseko — like Kyōgoku and Rankoshi — have started to feel the spillover effects, such as rising rent and traffic congestion without receiving equal investment.

🗾 Chapter 4: Hokkaido’s Identity Crisis?

The most contentious question is whether Hokkaido can retain its Japanese identity under the pressure of global luxury development.

Some local stakeholders argue:

- “This is no longer Japan. It’s a ski resort wearing a kimono.”

- Traditional onsens now require reservations in English.

- Local dishes are being replaced by fusion cuisine catering to foreign palates.

Others, particularly younger entrepreneurs, see opportunity:

- Hokkaido’s dairy and agricultural products have gained new luxury value.

- Regional crafts and cuisine are finding new global audiences.

- The Niseko brand is drawing attention to the broader region, including Furano, Tomamu, and Lake Toya.

So is Niseko Japan’s loss, or Hokkaido’s gain? The answer may depend on how future policies balance foreign capital and cultural preservation.

🚆 Chapter 5: The Role of Infrastructure

What will push the bubble even further is the upcoming Shinkansen extension to Kutchan, expected to open in 2030.

Currently, reaching Niseko requires either:

- A 2.5-hour car ride from New Chitose Airport.

- Or a combination of local trains and buses.

But with the Hokkaido Shinkansen stopping directly in Kutchan, travel time from Tokyo may shrink to just 4.5 hours door-to-door. This will undoubtedly:

- Raise real estate values further.

- Increase investor interest from Tokyo-based elites.

- Drive up seasonal tourism, especially from wealthy Asian travelers.

Other towns like Furano and Rusutsu are already preparing for “second wave” investment, branding themselves as “The Next Niseko.”

🧠 Chapter 6: Lessons from Global Ski Bubbles

Niseko isn’t the first ski resort to go global. Other examples offer insight:

- Aspen, USA: Now home to billionaires but struggles with worker housing.

- Whistler, Canada: Real estate boom priced out locals; government now subsidizes employee housing.

- Zermatt, Switzerland: Strict zoning preserved charm but limited growth.

What makes Niseko different is:

- Japan’s historically closed real estate market has been relatively relaxed in Hokkaido.

- There is no foreign ownership restriction on land.

- Weak yen makes Japanese assets attractive.

- Japan offers political stability and cultural safety.

But the question remains: Can Niseko avoid the mistakes of its Western counterparts?

📉 Chapter 7: Is a Crash Coming?

Some economists warn of a classic bubble scenario:

- Too many luxury developments chasing limited demand.

- Climate change threatening snow reliability.

- Global economic instability shaking high-net-worth investors.

Yet, as of mid-2025, the appetite for Niseko assets shows no sign of slowing. Instead, developers are now exploring summer tourism opportunities — hiking, golf, cycling — to create a “year-round luxury ecosystem.”

If the bubble bursts, it may not be due to oversupply, but external factors such as:

- A sudden yen appreciation.

- Tighter foreign investment laws.

- Natural disasters or geopolitical risk.

🔚 Conclusion: Niseko’s Boom, Hokkaido’s Future?

The Niseko Bubble is a case study in how globalization, tourism, and real estate can collide in unexpected places. For now, it has brought wealth, jobs, and visibility to a once-quiet corner of Japan.

But whether this is the rise of Hokkaido as a new Monaco, or just a temporary gold rush, will depend on how Japan navigates:

- Real estate regulation,

- Cultural preservation,

- And the widening gap between locals and visitors.

As the Shinkansen approaches and foreign investment deepens, one thing is clear:

Niseko is no longer just a ski resort — it’s a symbol of Japan’s evolving relationship with wealth, land, and identity.