If you’re new to investing in Japanese stocks, you might be surprised to find that many companies in Japan offer more than just dividends to their shareholders. Welcome to the world of 株主優待 (kabunushi yūtai) — or shareholder perks, a uniquely Japanese way of rewarding investors.

🎁 What Are Shareholder Perks?

In Japan, shareholder perks are special gifts or benefits given to shareholders, typically once or twice a year. These perks are separate from dividends and can range from discount coupons and free products to local specialties or even company-branded merchandise.

To receive these perks, investors must usually hold a minimum number of shares and be on record by a specific record date, often at the end of March or September.

🏢 Why Do Japanese Companies Offer Perks?

Shareholder perks are a form of shareholder return, but their purpose goes beyond financial incentives:

- Customer Loyalty: Companies like retailers and food manufacturers use perks to encourage shareholders to become loyal customers.

- Stable Ownership: Long-term holders are more likely to receive higher-tier rewards, encouraging investors to hold shares over time.

- Corporate Identity: Some perks showcase the company’s products or local culture, acting as a form of branding.

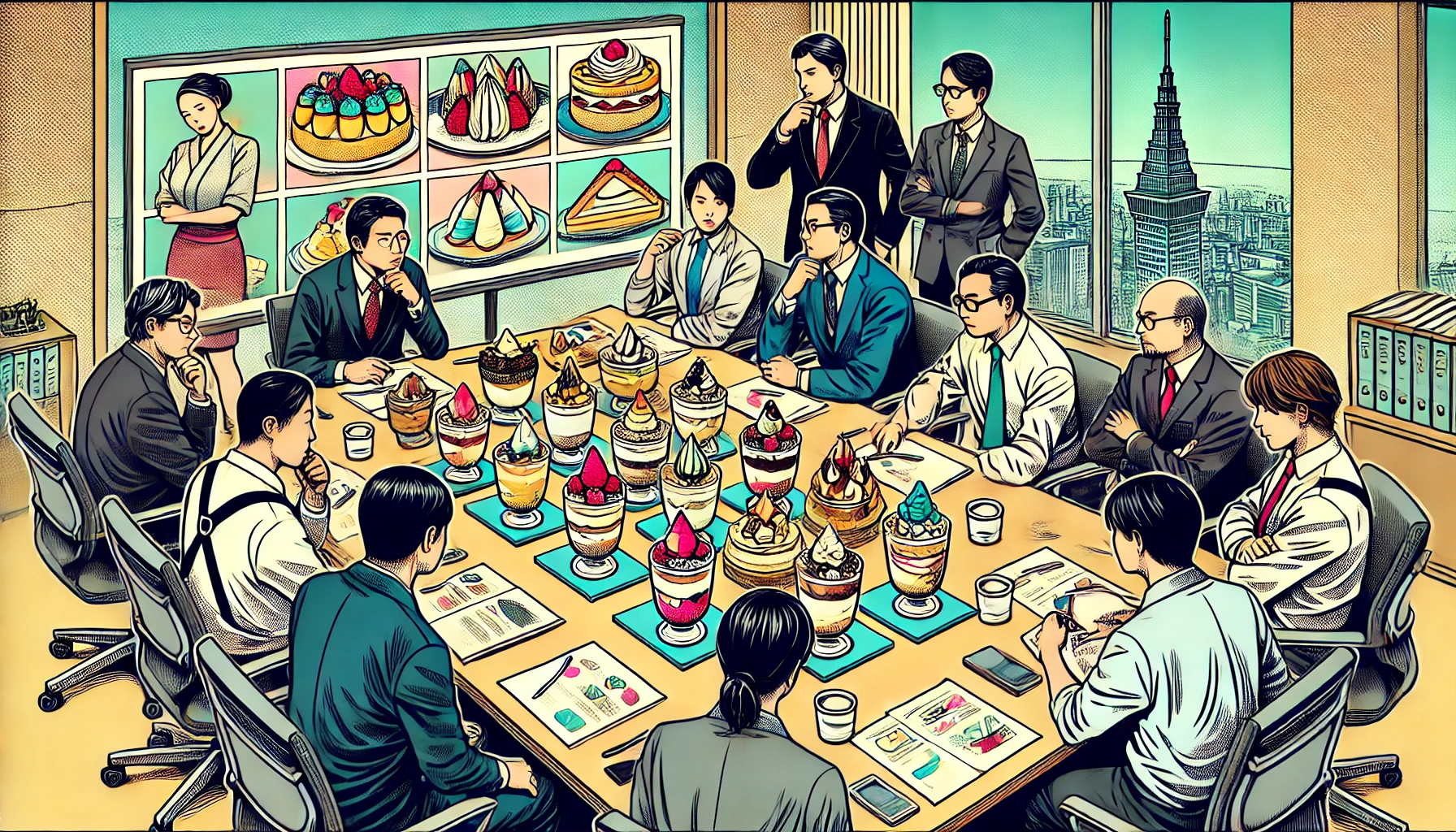

🍜 Examples of Popular Shareholder Perks

Here are some well-known examples:

| Company Name | Type of Perk |

|---|---|

| AEON | Shopping discount cards for group stores |

| Kirin Holdings | Assorted beer and beverages |

| Ryohin Keikaku (MUJI) | Gift vouchers for MUJI products |

| Kagome | Tomato-based product sets |

| ANA Holdings | Domestic flight discount coupons |

These perks often have monetary value and can be seen as non-cash dividends — many investors even choose stocks just for the perks!

📈 Is It Worth It for Investors?

Pros of investing for perks:

- Enjoy real products or experiences from companies you support

- Tax-free compared to dividends (in some cases)

- Incentive to stay long-term, reducing trading stress

However, keep in mind:

- Perks are not guaranteed and can be discontinued

- They can distort financial valuation if perks outweigh dividend yield

- You may need to hold large share quantities to qualify

🌍 A Japan-Only Phenomenon?

This system is rare outside Japan. While U.S. or European companies focus on dividends and buybacks, Japanese firms value these symbolic returns. It reflects Japan’s investing culture, which often emphasizes emotional connection, long-term ownership, and brand loyalty.

📌 Final Thoughts

Whether you’re a serious investor or a Japan enthusiast, shareholder perks offer a fascinating look into Japan’s stock market. They’re not just about profits — they’re about participation. It’s one reason why investing in Japan can be surprisingly fun.